Financing

Resources

Finance Partners for Your Equipment Needs

Lift Truck Center is proud to be aligned with Toyota Industries Commercial Finance (TICF), our captive finance partner for Toyota Material Handling and Toyota Advanced Logistics products.

We review each finance or lease opportunity to determine how we can structure the best overall package for you with a combination of competitive interest rates, customer service, flexibility and residual value/end of lease expectations (for leases). Other highly valued finance partners include PNC and Wells Fargo that understand the nature of industrial equipment. We also work closely with your preferred finance companies.

Today, there are many types of finance and lease plans available. We will do our best to understand your equipment usage so we can determine the economic life of the equipment based on your operating environment. Electric powered equipment normally have a longer economic life cycle than engine powered lift trucks. For that reason, we can offer a longer lease term, which in turn reduces your monthly payment.

We will do our best to help you understand important differences in leases that many other dealers fail to mention. For example, a closed lease has a guaranteed residual value from the lease company or dealer. In an open end lease, you are responsible for the value of the equipment and any deficiency between the realized vs. residual value.

Regardless of whether you lease or outright purchase, establishing an economic life cycle decision for your equipment is a pivotal piece for managing and controlling the cost of ownership. We often find excess, aged equipment that is in service (initially intended to be used as a "backup") that is costing large amounts to maintain with very low utilization.

There are several important components that are part of making the best equipment purchase/lease decisions.

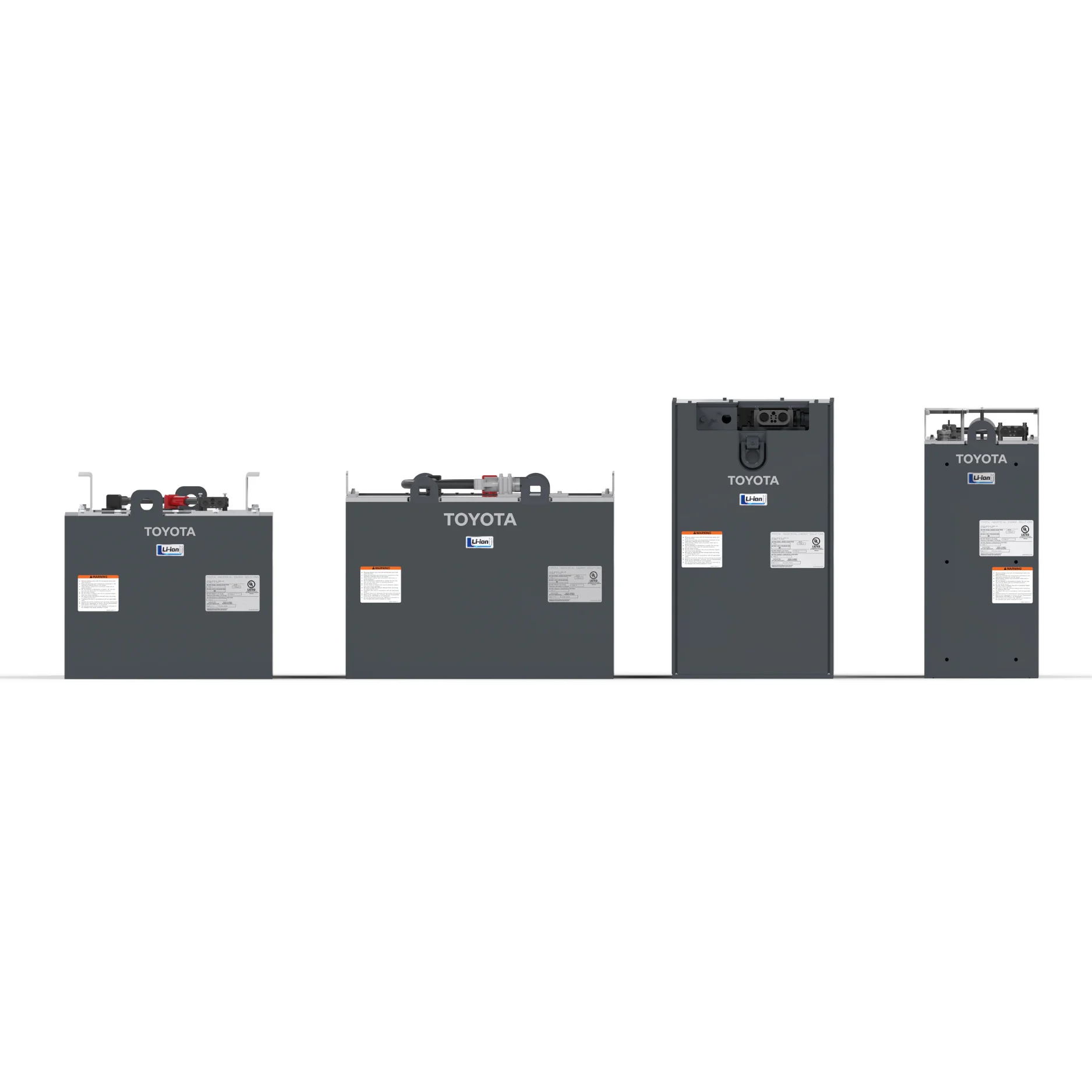

- Determine the best brand that is known for highest quality, safety, ergonomics and productivity

- Identify the model and specifications (i.e. electric vs. engine power) that offer you the most versatile use, lowest cost to maintain, longest life cycle, and highest future residual or trade-in value

- Purchase from a reputable dealer and people that are known for quality service that invests in the training of their team (and parts inventory)

- Understand the benefits of a lease (operating expense) vs. ownership depreciation within the structure of your organization

- Allow us to professionally get to know you and your needs. Invest in the relationship with the company that you choose to do business with. Active communication, understanding changing dynamics in usage or application within your operation are important to structuring maintenance (value) at the proper intervals. Remember, these are the individuals that you need in your corner to support you with responsive service when you are out of service and in a pinch to move products.

Lift Truck Center Finance Solutions

- New and Used Lift Truck Lease and Loan Financing

- Pre-approved Credit Lines

- Master Lease Agreements

- Dedicated Finance Experts

- Lease with Full Maintenance Single Payment Options Available

- Apply Directly through Lift Truck Center to get a quote Today!